Understanding the Power of Lower-Middle Market Private Equity

Where Small Business Meets Big Opportunity

The landscape of private equity investment presents numerous opportunities, but perhaps none as compelling as the Lower-Middle Market Private Equity (LMMPE) sector. This segment represents a sweet spot in the investment world, targeting enterprises with annual revenues ranging from $1 - $40 million – a category that encompasses an astounding 99.9% of American businesses.

The Vast Universe of LMMPE Opportunities

According to Small Business Administration statistics, approximately 33 million businesses fall within the LMMPE target range. This expansive opportunity set gives LMMPE funds a distinct advantage over their larger counterparts. While billion-dollar private equity firms must focus on a limited number of large acquisitions – typically 10-20 per fund – due to operational constraints, LMMPE managers can explore a vastly larger pool of potential investments.

Strategic Growth Through Acquisition

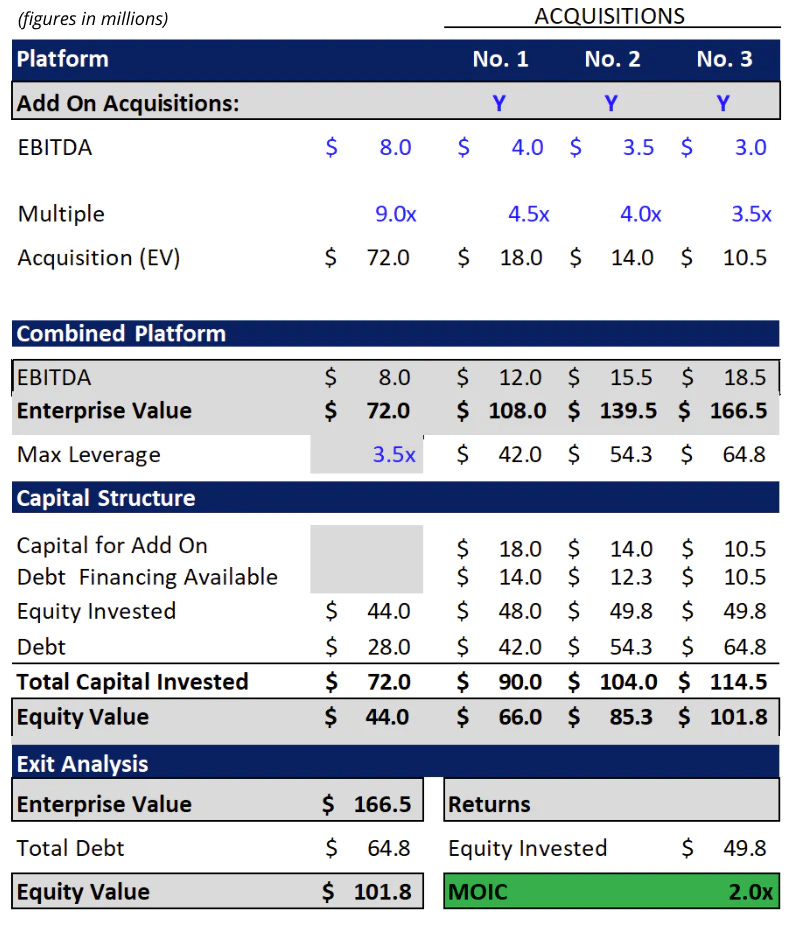

One of the most potent strategies in the LMMPE playbook is growth through strategic acquisitions. Fund managers typically begin by identifying and securing a "platform" company – a foundational investment that serves as a springboard for future growth. From this base, they pursue carefully selected add-on acquisitions that complement the platform's existing operations.

These add-on acquisitions often provide:

Complementary products or services that enhance the platform's offerings

Geographic expansion opportunities

Access to new technologies or market segments

Potential for multiple arbit

rage due to size differentials

Example of LMMPE add-on strategy:

The Multiple Arbitrage Advantage

LMMPE firms can create substantial value through multiple arbitrage – acquiring smaller companies at lower valuations and integrating them into larger platform businesses. This strategy can significantly enhance overall portfolio value, even before accounting for organic growth and operational improvements.

Operational Excellence: The Hidden Gem

Many LMMPE target companies have operated without institutional investment throughout their history. This presents a unique opportunity for value creation through:

Implementation of sophisticated financial controls

Optimization of capital structures

Introduction of professional management practices

Access to experienced operating partners and industry experts

The Growing Seller's Market

A significant demographic shift is creating unprecedented opportunities in the LMMPE space. Recent research from Wells Fargo reveals that 52% of families do not want to pass their family business down to their children. Additionally, a UBS survey found that 21% of business owners - most of whom generate $1 - $10 million in annual revenue - are actively considering private equity exits.

This trend is particularly favorable for LMMPE firms because these businesses often feature:

Limited previous institutional investment

Substantial room for operational improvements

Motivated sellers seeking liquidity

Strong potential for value creation

Flexible Exit Strategies

Unlike large-cap private equity firms, which often face limited exit options, LMMPE investments benefit from multiple potential exit paths. These can include:

Sales to strategic buyers

Acquisitions by larger private equity firms

Management buyouts

Strategic mergers This flexibility enhances negotiating leverage and potentially improves return outcomes.

The AI Opportunity in LMMPE

As artificial intelligence reshapes the business landscape, LMMPE firms are uniquely positioned to capitalize on this transformation. Small and medium-sized businesses increasingly recognize the necessity of AI integration but often lack internal capabilities. This creates compelling opportunities for LMMPE firms to:

Invest in IT service providers

Build platforms focused on AI implementation

Create value through technological transformation

Leverage fragmented market opportunities

Understanding the Risk Landscape

While LMMPE offers significant opportunities, investors should carefully consider several risk factors:

Limited liquidity typical of private equity investments

Impact of leverage and interest rate fluctuations

Higher volatility due to business size

Customer and supplier concentration risks

Operational execution challenges

Strategic Success in LMMPE

The key to successful LMMPE investing lies in thorough manager selection and strategy evaluation. Essential factors include:

Proven experience in the lower-middle market

Clear investment strategy and execution capability

Strong network of financing relationships

Demonstrated operational improvement expertise

LMMPE continues to offer compelling return potential, particularly for investors who understand the unique dynamics of this market segment. Success requires careful manager selection, thorough due diligence, and a clear understanding of both opportunities and risks in this dynamic investment space.